Be Ready For SiriusXM To Dip

Things are not looking good. This equity is a week away from a conference call that will be pretty ho-hum, and the technicals are breaking down. We now have developed 3 warning flags, and this has to have many investors on the edge of their seats.

Do you stay in and hope for a stronger deal? Do you sell and buy Liberty? Do you get out now and let the dust settle? There is no easy answer. My opinion is that a slightly better deal may come to the table, but that does not mean it will be at $3.68. Let me say that again, because it is important. A better deal may not be the $3.68 that was the ratio on the announcement day.

[s2If !current_user_can(access_s2member_level1)]

Your focus needs to be on the ratio of series C shares to SIRI shares AND the number of C shares that LMCA and LMCB holders get. The initial ratio was 0.076 series C shares for each SIRI share. A Better deal could be 0.077. Personally, I think that the deal range is between…

[/s2If][s2If current_user_can(access_s2member_level1)]

Your focus needs to be on the ratio of series C shares to SIRI shares AND the number of C shares that LMCA and LMCB holders get. The initial ratio was 0.076 series C shares for each SIRI share. A Better deal could be 0.077. Personally, I think that the deal range is between 0.78 and 0.081. It may seem like a small improvement, but that is the reality of how narrow the range is that keeps this deal making sense to all parties.

If you are looking for a premium for future value, you would still own that potential. Future value is never a guarantee now or ever. Further, there is no guarantee that the future value if the deal happens will be worse, the same, or better than the current situation.

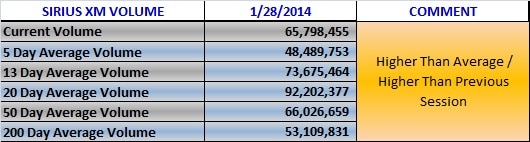

We saw SiriusXM move down today on higher than average volume. My concerns are that the Q4 call will be about the same as the Q3 call with added expenses of acquisitions, the satellite launch, etc. I will say it now. There is potential, unless a compelling catalyst comes along, for this equity to test even below the 200 day EMA. Think about that as you develop your investment strategy.

The best example I can give you on how to assess this deal is the following:

You live in a house overlooking the Ocean. It is a three bedroom house and is 6,000 square feet. You feel that the value of your home, because of its location overlooking the ocean, will increase 20% in the next year.

Your next door neighbor has an identical house in all respects accept that his house has a bigger yard (more acreage). He feels his house will increase in value 20% over the next year for the same reasons you do.

Now, if you had no desire to move to a new town, you may be able to command a premium on current value. Because you are being asked to give up that great view. However, what is being offered is a swap. The neighbor wants to move into your house and you to move into his. His house, because he has more land is a bit more valuable, but he forgoes that premium and wants a simple swap.

In this example, you would still have a house that will increase 20% in value, and still have the same house with the same view. That is what we have here. You are not being asked to walk away. You will still see the potential, so why should it be paid for twice… once up front and then again when it happens?

I realize that expressing this sentiment does not gain me fans. I am not here for fans. This is the type of parameters that Evercore and the independent directors will be assessing. That is what we all need to be aware of. Just because you and I think that the future value of SiriusXM is $4.50 does not mean that we can command such a price in this deal. In fact, $4.50 in this type of deal is impossible… never mind those fruitcakes that are saying $5 or $6. Anyone… and I mean anyone… that is preaching $5 or $6 is selling you a bill of goods that does not exist.

Now to the technicals. What we need to be cautious of is $3.61. If this equity is not above $3.61 prior to the call, we could be in for a world of hurt. It is that simple… the charts below speak for themselves.

Volume

Support and Resistance

Exponential Moving Averages